German Gref estimated 1.5 trillion rubles in underpaid taxes by marketplaces.

Sberbank published a report titled "Tax Arbitrage on Marketplaces," in which it explained in detail for the first time how the 1.5 trillion ruble figure came to be calculated . This is the amount of tax shortfall the bank expects the budget to lose in 2026. In 2025 , Sberbank estimates the shortfall will amount to 1.1 trillion rubles .

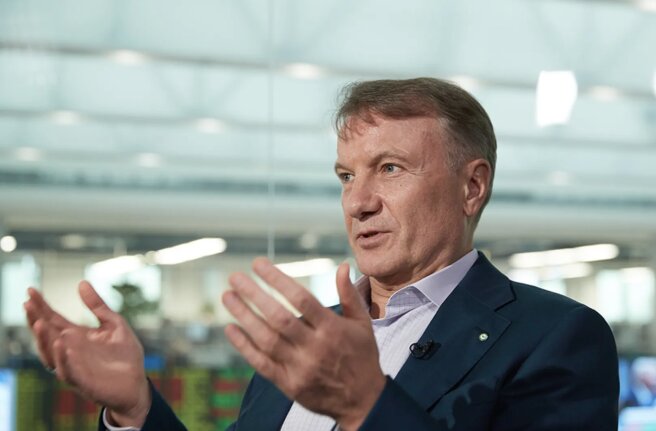

A week ago, German Gref stated that online trading platforms are "beyond tax competition," and that discounts on marketplaces are essentially "at our own expense."

Where did the amount come from?

Sberbank compared two tax regimes:

Potential VAT revenue from all sales on marketplaces, if they were taxed at the average rate for traditional retail, is 21%.

The actual VAT paid by sellers operating primarily under the simplified tax system or as non-residents is either at reduced rates or without VAT at all.

Thus, we are not talking about a violation, but about “tax arbitrage” – a difference between regimes that allows some market participants to pay less than others for similar activities.

What Sber's analytics showed

60% of marketplace turnover comes from micro- and small businesses using the simplified tax system—approximately 6.8 trillion rubles in 2025. Sberbank explained how it calculated…

The greatest benefit goes to grey import participants , who pay neither import VAT nor customs duties.

7% of sellers, accounting for 18% of turnover, register in regions with simplified tax system (STS) benefits—Kalmykia, Udmurtia, Mordovia, Chechnya, and Dagestan. Budget losses from such mass registrations are estimated at 60 billion rubles per year .

Sberbank also noted that the development of marketplaces coincides with a decline in the number of traditional retail companies—both small and medium-sized businesses and large ones.

Pricing and sales model

Sber gives an example:

The iPhone 16 Pro Max 256 GB costs 131,000 rubles in offline retail.

On the marketplace for the 1P model - 118,000 rubles .

For a non-resident, it's 111,000 rubles . The bank estimates the difference is due to the sellers' lower tax burden. Sberbank explained how it calculated...

What's going on around

Against this backdrop, regulators are discussing new restrictions for platforms. The Central Bank has proposed banning marketplaces from:

set discounts depending on the payment method;

sell products of subsidiary banks on their platforms.

Banks also opposed linking discounts to specific payment methods.

Wildberries founder Tatyana Kim believes the proposed measures are aimed simply at eliminating competitors.